IRAs are one example of a use-specific plan, which the government loves. The 529 College Tuition Plan is another example; it’s extremely tax-efficient for the investor if used for college, but extremely tax-inefficient if used for retirement. Similarly, IRAs are designed to encourage people to save money for retirement, and if the money is used for that purpose, then it’s taxed in a friendly manner. If it’s used for anything else, it’s not.

The challenge for the IRS in providing this incentive for retirement savings has been the same challenge faced by the Social Security Administration in maintaining the system’s solvency: people are living longer. Today, there is a 50% chance that the average 65-year-old American will live into their late 80s. For the average couple aged 65, there is a 50% chance that at least one spouse will live to age 92. The IRS doesn’t want to wait until your death to get its tax money because it might end up waiting a very long time. Thus, everyone is required to begin taking minimum distributions from their savings plans after age 72.

To the government’s credit, it has actually lowered RMD percentage amounts in recent years because it recognized that increasing longevity rates were creating challenges from the other end as well, with some people legitimately worried about depleting their IRAs before they died. The bottom line is simply that the IRS doesn’t want retirement income vehicles to be used as inheritance vehicles, so they require you to take minimum amounts of income from those vehicles each year once you’ve reached the requirement age.

When Do I Take RMDs?

Again, the general rule is that you have to start taking RMDs in the year you turn 72.

The one exception to all of this is for someone still employed at age 72 at a business that they do not own. In that case, you do not have to take Required Minimum Distributions on that particular retirement plan. You still must take them on any other retirement plans, such as your IRA, but not on the plan that’s with a company for which you are still employed at age 72.

How Much Do I Owe?

The penalty for not taking sufficient RMDs each year after age 72 is significant — 50 percent — so it’s important to do your calculations correctly. The good news is that, in addition to reducing RMD amounts in recent years, the government has also made it easier to calculate what you owe. Here is basically how it works:

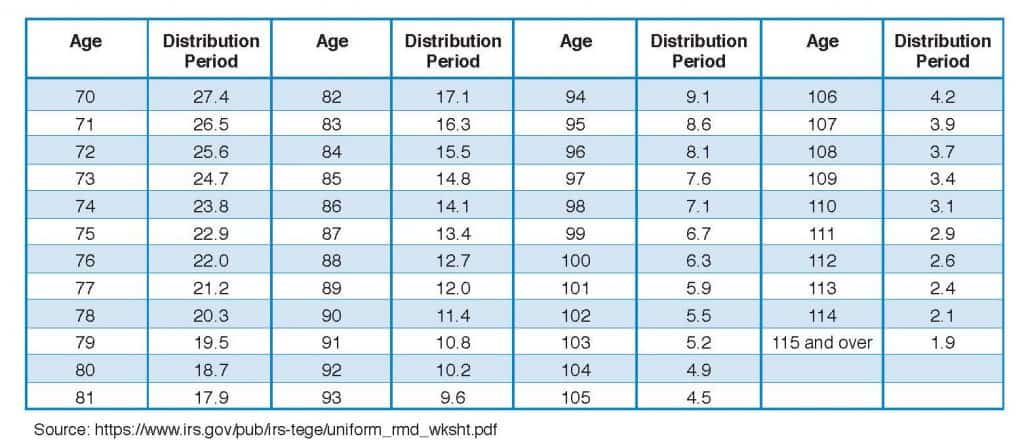

– IRS Publication 590 gives you a uniform table with a government-assumed life expectancy for each age past 70. Note that your government-assumed life expectancy is actually much longer than your statistical life expectancy:

– To calculate your RMDs, take the balance of your IRAs on December 31st of the previous year and divide it by this life expectancy factor.– At age 72, that RMD equals approximately 3.7% of your IRA balance and increases every year as you get older.

While this process is simpler than it used to be, it’s not totally easy. The uniform table formula above applies to unmarried IRA owners and owners whose spouses are not more than 10 years younger. A separate formula and a separate table exist for IRA owners whose spouses are more than 10 years younger, and generally their RMDs end up being lower.

There are other complications as well. For instance, certain kinds of annuities have to be separated from the basic calculation, and those RMDs must be calculated differently. Specifically, these are annuities that are annuitized or have to be annuitized at some point in the future. These particular instruments increase the dollar amount of your RMDs and therefore also increase the amount of taxes due on them.

Another complication is that when one has IRAs but also any form of qualified plan — such as a 401(k), 403(b), or 457 — the RMDs from the IRA and each of these plans must be calculated and made separately; they cannot be commingled. This is one of the major reasons (though not the only one) that most people roll over their qualified plans into IRAs before age 72; it makes life simpler.

What About Taxes?

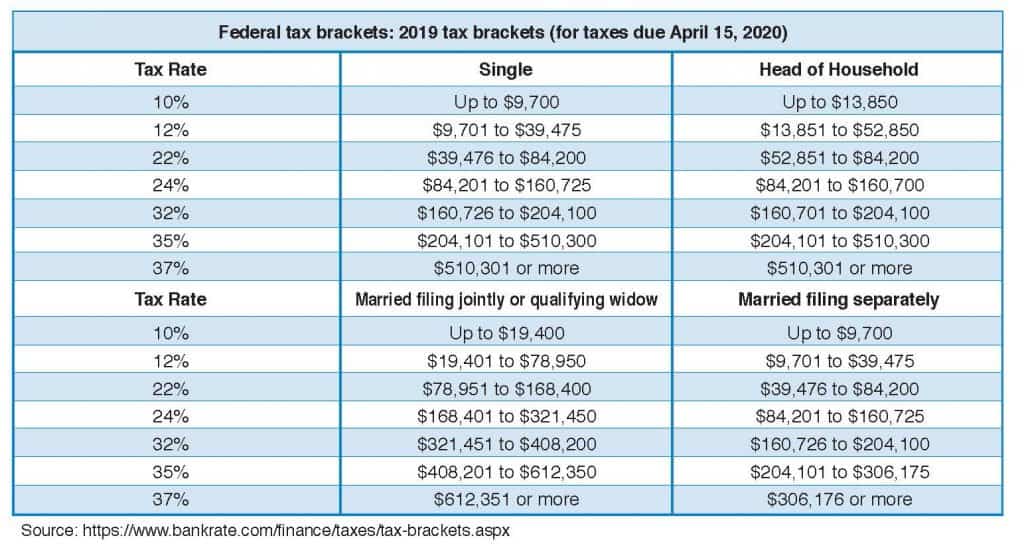

The amount of extra tax liability you have because of your RMDs depends on many factors, including your personal situation and how much income you have from other sources. The key is to understand the concept of a marginal tax bracket, which is based upon an average of all the tax brackets that you’re currently in. For example, if your marginal tax bracket according to your tax preparer is currently 17.3%, it’s because you have 1) maximized your 10% bracket, 2) maximized your 15% bracket, and 3) had some income in the 24% bracket. The blended rate is an average of 17.3%. However, once Required Minimum Distributions get stacked on top of your other income sources, your marginal tax bracket will be 25% and the RMDs will be taxed accordingly. Income tax brackets for RMDs are: 10%, 12%, 23%, 24%, 32%, 35%, and 37%:

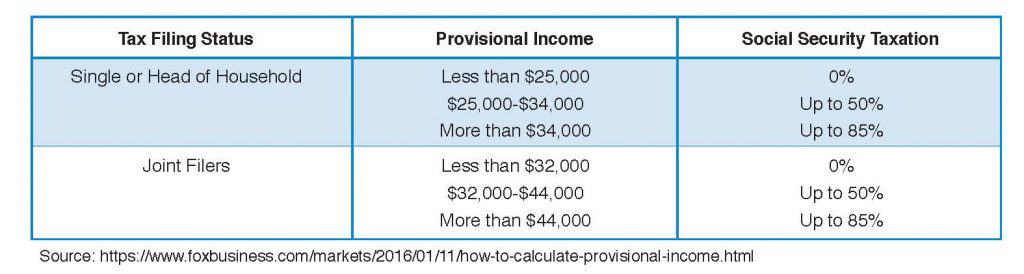

However, even with all this information, there are still other factors to consider when it comes to RMDs. One of them is Social Security. Every extra dollar of taxable income generated from any source, including RMDs, might cause a greater part of your Social Security benefit to be taxed.

This is where your RMD calculation gets very challenging because it can potentially become a perpetual loop calculation that might change every year depending on your personal situation:

Don’t Try This at Home

Whatever that situation may be, the most important thing for you to consider regarding RMDs (as well as Social Security) is whether or not your asset allocation is suitable and sufficient to generate the amount of minimum distributions you need to satisfy your requirements. It should be generating at least 3.7% dividend or interest. If you’re relying on capital gains each year for your RMDs, then, in essence, you’re taking them from principal, which is a slippery slope that you definitely want to avoid.

While it is smart and advisable to use IRS Publication 590 and other available information and resources to estimate your RMDs, the process of creating a sound, retirement plan that suits your needs and meets your goals is best done in collaboration with a qualified professional financial advisor. In today’s economic climate, an advisor who specializes in the universe of non-stock market income-generating investments is uniquely qualified to work with you to devise a plan that satisfies your RMDs, maximizes your Social Security benefits, and provides the kind of reliable income, reasonable growth, and level of portfolio security you need to meet your goals with confidence and peace of mind.