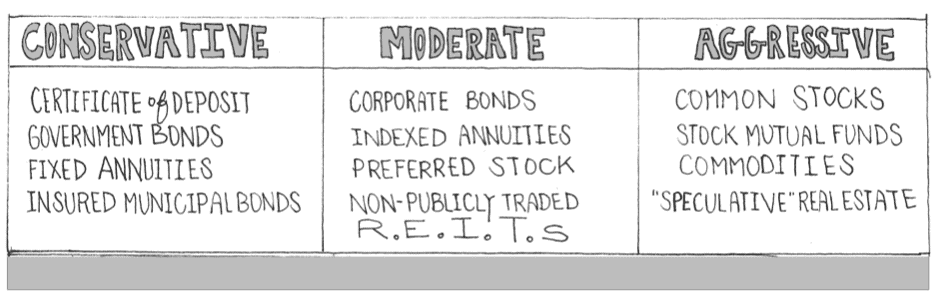

On the left of the chart are investments that are considered to be conservative because, in theory, they are deemed to have no default risk. These include bank CDs, government bonds, fixed annuities, and insured municipal bonds. In the middle are moderate instruments that have some default risk but that are generally considered to have a much lower risk of loss than aggressive investments. These moderate options include corporate bonds, indexed annuities, preferred stock, Real Estate Investment Trusts (REITs), and Business Development Companies (BDCs).

The instruments on the left and in the middle have two things in common:

1. They’re considered to have less risk of loss than the instruments in the aggressive category

2. They are instruments that people invest in primarily for income.

In other words, they are not instruments that people typically invest in first for growth — although they do appreciate in value. The interest and dividends that are typically yielded by the vehicles on the left and the middle represent a way for you to generate reliable income and grow your money “organically” through the reinvestment of the interest and dividends that you may not need for income. This is the “bird in the hand” approach to portfolio growth. You aren’t crossing your fingers and toes hoping for capital gains to provide growth; you’re building strategically through a level of growth that’s dependable.

Bond Mutual Funds

If you’re considering investing in the vehicles on the left and in the middle of the chart and most of your previous experience has been investing in the stock market or mutual funds, you should not take a do-it-yourself approach. Rather, seek professional guidance from a qualified financial advisor. There are many complex factors to consider when investing in these conservative and moderate options, some of which will be shared with you in the next few pages. First, let’s talk about a popular investment tool you may have noticed is conspicuously absent from the previous chart: bond mutual funds.

Generally, advisors who specialize in income-generating instruments, as opposed to the stock market and growth-oriented instruments, work more with individual bonds and bond-like instruments rather than bond funds. That’s because when an investor buys an individual bond, they have two important guarantees: a fixed rate of interest for the life of the bond and the return of their face-value investment upon maturity. Both guarantees assume that there have been no defaults, but with that assumption, an investor knows exactly what they’re going to earn on the individual bond if they hold it to maturity.

By comparison, interest rates on bond funds can fluctuate, so they aren’t guaranteed, and bond funds also have no fixed maturity date. If they end up not maturing, then you can’t hold them to maturity and therefore can’t get your face-value investment back. In short, the two guarantees that mitigate your investment risk in individual bonds don’t exist with bond funds.

That’s important because many factors can cause bonds and bond mutual funds to fluctuate while you hold them. Most people have heard that when interest rates go down, bond values tend to go up, and vice versa. However, that’s really an oversimplification and just one of the many factors that can impact bond prices during their lifetime.

With all that in mind, imagine that you’re a client of an advisor who specializes in individual bonds while your friend Joe is with an advisor who’s put him in bond mutual funds. If something happens in the bond market to cause bond values to drop, a portfolio of individually held bonds and a bond mutual fund might drop similar amounts in value, but because you’re in individual bonds, yours is only a paper loss. If you choose to hold those bonds in your portfolio to maturity, then, as noted, you will get your face value back at that time — again, assuming there have been no defaults. But, because Joe has mutual funds, his loss might never be recaptured, as bonds mutual funds never mature. In other words, a loss that might have only been a temporary paper loss in individual bonds can turn out to be an actual monetary loss in bond funds.

Since that’s the case, you might wonder why so many financial advisors utilize bond mutual funds instead of individual bonds. One possibility is that the majority of advisors today specialize in growth-oriented, stock market-based strategies: those in the aggressive column. Advisors who specialize in the stock market or the growth side are often not very proficient at fixed-income analysis, which is very different. Therefore, it is easier for those advisors to recommend a bond mutual fund than a portfolio of individual bonds because, in so doing, they are leaning on the fund manager to pick the individual bonds. Bond funds really are a simpler way for stock market-based advisors or even do-it-yourselfers to invest in the bond market. But, like most things in life, simplicity comes at a cost. In this case, the cost of Joe exposing himself to significantly more risk with bond mutual funds was greater than you had with a portfolio of individual bonds. 4

Variables to Consider

Returning to the chart, understand that if you are investing in the different categories of individual bonds or even preferred stocks, there are many variables to consider. First is the creditworthiness of the issuer. The higher the issuer’s credit rating, the less the interest or dividend that gets paid, and the lower the credit rating, the higher the interest or dividend that gets paid. In the case of municipal bonds, you also need to understand how your marginal tax bracket affects your decision. The next thing you need to consider is the maturity date. However, you should also look at the yield curve to see where you will get the most bang for your buck.

Consider the yields offered on various types of fixed-income securities. There are at least four different types of quoted interest rates that all mean different things, which means you need to understand such things as an individual security’s coupon rate, current yield, yield to maturity and yield to call, and whether a bond is callable/noncallable or convertible/nonconvertible.

This is all just an overview, but I hope it gives you a sense of why I strongly suggest working with a qualified advisor who specializes in fixed-income instruments if you have no real-world experience with them yourself. You can probably also understand why many stock market-based advisors prefer to “keep it simple” by working with bond funds.

You may be wondering about the wisdom of buying bonds in today’s market with interest rates so low, thinking that when interest rates go back up, bonds will invariably drop in value. Your concerns are probably based, to a large extent, on the fact that many stock market-based advisors and Wall Street firms have been actively promoting that very message. But this focus on a “bond bubble” is primarily a scare tactic being used in an effort to keep investors from moving out of the stock market and into bonds. As explained, if you plan to hold bonds to maturity, interest rates largely become moot, and there are many factors that impact bond values besides interest rates.

One such factor is the premium. When interest rates go up, it’s because the economy is doing well and investors are becoming more confident. At that time, they typically require a lower risk premium, which means there will be less additional interest to go from government bonds to corporate bonds. This will partially offset the negative effects that increasing interest rates can have on bond values.

Returning to the chart, let’s look at annuities. Odds are you already know these can be extremely complicated investment tools. Some have embedded fees, and some have no fees at all. Some are subject to market volatility, and some have zero volatility risk. Some are irrevocable, and others are more flexible. In fact, there are so many factors to consider with annuities that unless you have real-world experience with the various types of annuities, you certainly shouldn’t pursue this option without the help of a qualified specialist in income-generating investment strategies.

Regarding REITs, the options are also extremely varied. When choosing REITs, one needs to look at the type of real estate that the REIT is invested in, the average length of the leases within the REIT, and the profile of the major tenants, along with many other factors. Simply put, REITs are every bit as varied and complex as annuities.